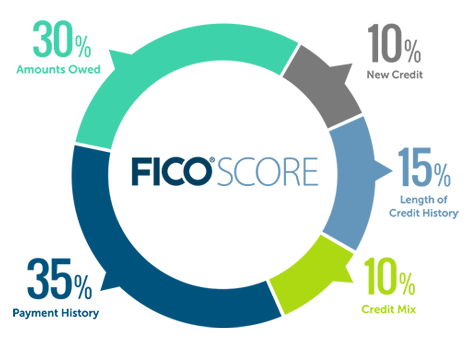

Having knowledge of your credit can help when applying for any type of credit. Lenders look at two aspects of your credit; your FICO (Fair Isaac Corporation) Score and your credit report. Here we will concentrate on basic aspect of FICO Score.

Author: Admin

Lesser known credit for retirement savers

Those who are saving for their retirement through IRA or an employer sponsored retirement plan, may be eligible for a “saver’s credit” in their 2014 Federal tax filing. A person over the age of 18, not a full-time student and not being claimed as a dependent on another person’s tax return is eligible for the credit. You need to use Form 8880, Credit for Qualified Retirement Savings Contributions to claim the credit and file Form 1040 or Form 1040A.

The History of Valve Corporation

Gabe Newell and Mike Harrington left Microsoft in the mid 90s after seeing that Doom had a larger install base than Windows did. Newell recalls that the Microsoft sales people were racking their brains trying to figure out how to outsell a DOS based video game. After seeing that potential, Newell felt he could add something to the process.

Advantages of Exchange Traded Funds over Mutual funds

Article Written by : Scrumpy Jack

The Exchange Traded Fund (ETF) industry is a $1.5 trillion strong and expanding exponentially. At the same time the luster of mutual fund industry is taking a back seat. Why ETFs are so hot? There are several reasons.

Don’t overlook these tax deductions

There are certain payments that you pay that are eligible for a tax deduction but most people overlook them. Here are some of those instances.

For those who are self-employed, your health insurance premium is tax deductible. This includes your medical, dental, and long-term care insurance premium you pay for the whole family. Under the Affordable Care Act, 2014 tax filing for some may cost additional taxes. All individuals are required to carry health insurance and those without may have to pay a penalty.

We all know that we can deduct interest we pay on our mortgage when we file taxes. But, how about points we paid when we bought a new home or refinanced an existing mortgage? Some people pay points to lower their mortgage interest rate. Your cost to pay for points is deductible. However, they are to be spread over the life of the loan.

Deducting state and local taxes you pay get a bit complicated. States such as California and New York allow tax payers to deduct state and local taxes they pay. But not all states allow this. However, sales tax you pay on purchases is deductible for people who live in Florida and Texas. Remember to keep all your purchase receipts.

What happens to your credit score when you get married?

Many thinks that marrying someone with a lower credit score will result in automatically lowering the other spouses’ credit score. This is not true. It is true that after marriage creditors will look at both spouses credit reports. However, individual credit scores that existed prior to the marriage will continue with new credit information added.

Retirees, don’t overlook your state taxes

Article Written by : Financial Resources 101

When it comes to tax planning, many of us concentrate only on Federal income tax. Beware that there is a tax bite that comes from the state too. Unfortunately state tax from state to state differs and it is hard to generalize. Still some common themes can be identified. They include how states treat retirement income, Social Security, inheritance and property taxes.

Some debt can be good

Article Written by : Future Finance Solutions

Being in debt is normally not recommended by anyone. However, there are some debts such as taking out a mortgage, getting student loan to fund your education, and an auto loan to buy a car can be good.

Buying a home is part of “the American Dream.” It is the largest investment for many ordinary Americans. Don’t forget the tax benefits you get when you file your Federal tax return. Buying a home is not for everyone. In some expensive home price communities, only option available may be to rent. Also, people who don’t like repairs and maintenance, buying a home may not be a wise decision.

Student loans are cheap way to finance your education that will give you years of earning power. People with college degrees have more earning power, competitive advantage as well as advancement opportunities compared to fellow non-degree workers.

Buying a car with a car loan can help you to establish credit. If you can make a substantial down payment, it will lower your monthly payment. Shop around for a better loan rate and make sure to buy a car that you can afford without breaking the bank. Set aside some funds for maintenance.

Do not make this costly mistake in your beneficiary designation forms

Single mistake in your retirement funds can lockout your loved ones inheriting your retirement income. Even well-constructed plan prepared by veteran wealth advisors and attorneys could overlook this simple step. It is the correctly filled and properly filed beneficiary form. Properly completed document should contain name of each heir and the share of funds each designee should receive. Avoid referring to another document such as your will, testament and other final documents. This violates the instructions which calls for names and allocation percentages and therefore, violates the requirement to complete the form properly causing the form to be invalidated. Then the result may be not something you intended. In the absence of a property completed designation form, your IRA, bank accounts, stocks, annuities, bonds and other retirement funds may be distributed to your surviving spouse and children. It had happened to too many people where heirs learned a costly lesson.

Beneficiary forms may help your heirs to bypass probate and access funds immediately after your death. It is also important to update the form when changes occur. When you complete a form, keep a hard copy of it in your valuable documents so that your heirs can find it easily.

How the FDIC was Created

Most of us have heard the term “FDIC Insured,” but few actually realize what that means. The organization got its start in 1933, four years after the crash of the stock market in 1929. The history of the FDIC paints a picture of a country that hoped to shield its citizens from the potential troubles a bank giant could cause.