Having knowledge of your credit can help when applying for any type of credit. Lenders look at two aspects of your credit; your FICO (Fair Isaac Corporation) Score and your credit report. Here we will concentrate on basic aspect of FICO Score.

FICO Score is the widely used credit score by lenders and others. More than 90 percent of lenders use the score before extending a line of credit including a credit card or store credit card. There are three main credit bureaus that keep a score on you. They are Equifax, Experian and TransUnion. The government regulations require each one of them to provide a free copy of your credit report but FICO Score may or may not be included with it.

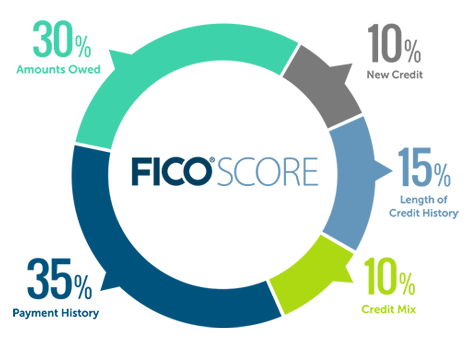

The score can vary from 300 to 850. Higher the score lower the credit risk thereby improving your chances to obtain a line of credit. In order to establish a FICO Score for you, you should have one open line of credit for at least six months. They look at your payment history, capacity used, length of credit, types of credit used and past credit applications on an assigned weighted scale. Knowing your FICO Score and what is in your credit report are essential for your financial success.