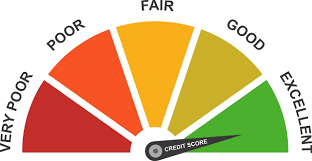

Your credit worthiness is measured by using FICO score. Your credit history, available lines of credit, on-time payment of bills, open lines of credit and many other factors contributes to formulate your FICO score.

Avoid opening too many credit lines: Your credit report reveals all open and closed lines of credit including credit cards and store credit cards. More credit cards tell the reviewer that you are heavily relying on credit. Also, applying for as many possible credit lines within a short period of time can also contribute to lowering your FICO score. Rule of thumb to follow, do not apply for credit that you do not need.

Review your credit report carefully: Your FICO score is not your credit report. Credit reports are maintained by three major credit bureaus, Equifax, Experian and TransUnion. Report contains many aspects of your financial life. You can obtain a copy of your report once a year, free of charge. One proven strategy is to get a copy of your report from one of the credit bureau every four months. What you are looking for is any errors that contribute to lower FICO score. Errors could occur due to similar names, birthdays and other factors. Also, if someone has stolen your identity, credit report can reveal that too.