If banks are to stay competitive in the near future, they will need to change some of their operating procedures. That’s easier said than done when you’re managing 200,000 people across the country. It’s even harder when that massive work force has been using the same methodologies for years. According to Phin Upham, who recently spoke at the Milken Institute Global Conference, new opportunities are presenting themselves for banks to service large segments of the population traditionally priced out by high interest rates.

Category: Finance

Two ways that could help your credit score

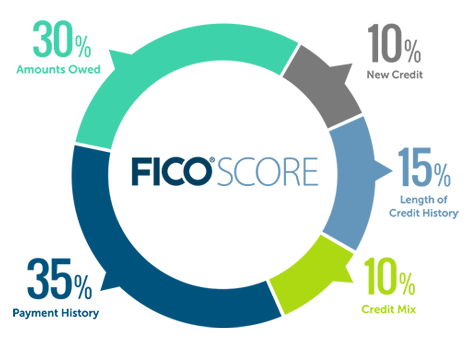

Your credit worthiness is measured by using FICO score. Your credit history, available lines of credit, on-time payment of bills, open lines of credit and many other factors contributes to formulate your FICO score.

Knowing your financial rights would help

Laws governing consumer rights for credit and other services are abundant in the United States. Consumer protection for safeguarding financial records, one should have a good understanding about their rights. Here we are attempting to explore some of those protections.

Since 1978, The Right to Financial Privacy Act limits government access to personal financial records and requires the government to follow a special protocol to look into your records. This includes your expressed consent, subpoena or a search warrant with certain exceptions.

Know your FICO Score before applying for credit

Having knowledge of your credit can help when applying for any type of credit. Lenders look at two aspects of your credit; your FICO (Fair Isaac Corporation) Score and your credit report. Here we will concentrate on basic aspect of FICO Score.